What are Demat & Zero Brokerage Accounts and How Might They Help You?

Many people who have made investments in the stock have familiar with the word ‘Demat Account’. Demat Account holds shares in a way which is electronic. The term ’demat’ stands for dematerialize account and holds the stocks electronically instead of the physical form. If you are an investor and have to buy or sell the stocks, then you have to open the account. The demat account is analogous to your bank account. The difference is, you transact money in bank account and you transact shares in the demat account.

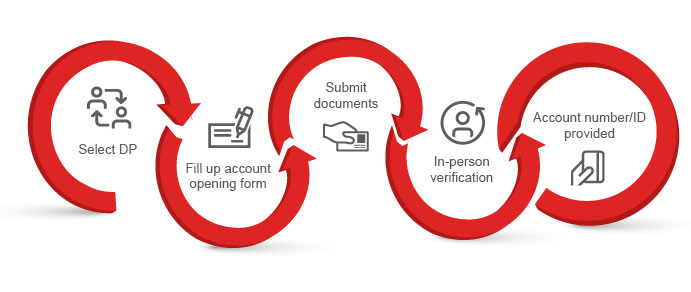

Nowadays most people do not transact the shares in physical form. It requires a lot of paperwork. The transactions are preferred in the dematerialized form. Thus it is very important in the investment and trading. If you want to open an account then you have to approach a depository participant and fill an account opening form. Your proof of identity and your proof of address are two mandatory documents you need to keep handy. Both the proof should be as per the Securities Exchange Board of India (SEBI) to open the account.

The demand account can be opened easily. There are 4 fees you will be charged. The opening fee is applicable when you open the account. You can go for the zero brokerage if you want to save money. All the depository participants demand an account opening fee. Zero brokerage account means the account holder does not have to pay anything when opening the account. This model allows you to pay once in a month or just a minimal amount for every transaction.

Whatever the size of your trade, you will need to pay a low amount with these plans. The maintenance plans charge is also popularly known as the folio maintenance charge. This is charged. The charges depend upon the number of securities you hold. The transaction fee is charged every time you transact securities through your demat account.

Why use a Demat account? It is completely safe to transact the securities through the demat account. The transferring does not require stamp duty. If you are a first timer then you will not be charged because of the zero brokerage fees. Also, to mention the safety it provides compared to physical forms like theft, destruction and bad deliveries. There is no need for complex paper works and transfer of securities with this method.

The issues with the sale of the physical shares can be eliminated altogether. Even a single share can be sold via the account. Shares are also credited automatically in the events of the merger, bonus, split etc. The first baby step towards the share market is opening a demat account. Signing up for the account keeps your securities secure and you can transact easily. So, what are you waiting for? Open the account in few minutes and with zero brokerage today.

Relevant news

What are Mutual Funds and Their Types?

Mutual funds don't have any such particular meaning but these are exceptionally important funds nowadays.…

Important Guidelines on Online Trading in India

Online trading has become the latest trend of trading in India. According to the market…